pianomanzano

DIS Veteran

- Joined

- Aug 9, 2021

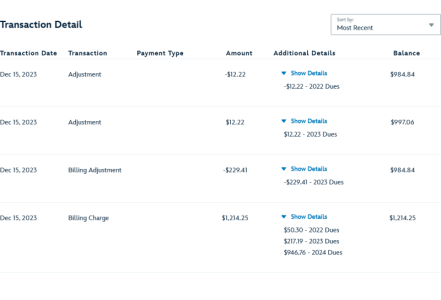

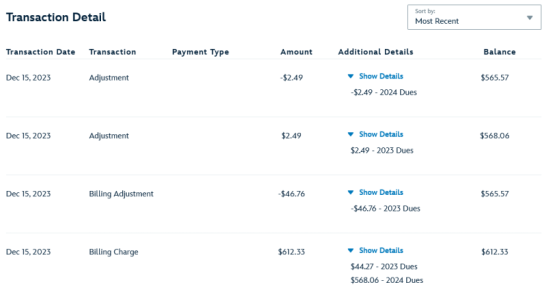

Looking at the transaction history for my contracts and seeing some discrepancies in my VGF contracts. Can anyone help explain the $0.33/point difference between my two VGF contracts? I'm assuming it's mostly tax adjustments. For context, the first one is a resale contract (125 points) we added in 2022 and the second one is a direct contract (75 points). Thanks!