newski_mom

DIS Veteran

- Joined

- May 4, 2022

I do pu with uber eats, grub hub and door dash to use my credits. Mostly I go to Johnny rockets, mod pizza abd red robin. The owner of JR knows my name from my monthly pu's

I'll have to look into Insta cart. I don't mind picking stuff up to get some "free" food.

ETA the only place close to me with pu is a local chain drug store that has crazy prices so will have to see what I can get.

The insta credit is 15 per month on csr?

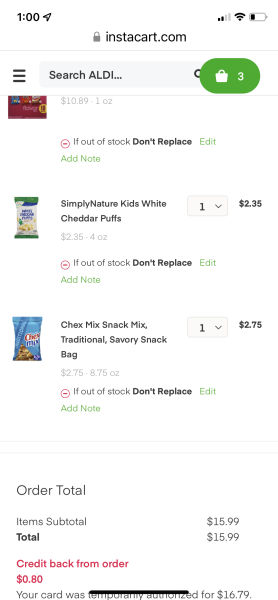

The insta credit is $15 per month on the CSR. I wanted to add too, that the only pickup insta place near me is Aldi. In order to get free pickup, you have to have a $35 order, so I got $35 worth of food for $20, but it was still worth it to me. They have the cheapest milk around, so I stocked up on that a bit and was easliy able to find $35 that we'd use to get the discount. It had been years since I'd shopped at an Aldi, but I think I'll enjoy the once a month pickup from there.

I want my 100,000 points. My first epic fail. Thank you all for understand as I know only you can.

I want my 100,000 points. My first epic fail. Thank you all for understand as I know only you can.