Your Annual Dues Statement and Privacy Notice are now available online.

DVC offers two options for Auto-Pay; a yearly payment on January 15th with a credit card or monthly payments with a U.S. bank account. By registering for Dues Auto-Pay, you can enjoy the magic of Membership without the worry of missing a payment.

To avoid late fees and interest assessments, Annual Dues payments must be posted to your account by February 14th. Late fees and interest will be assessed beginning February 15th, and each month thereafter on any past due balance.

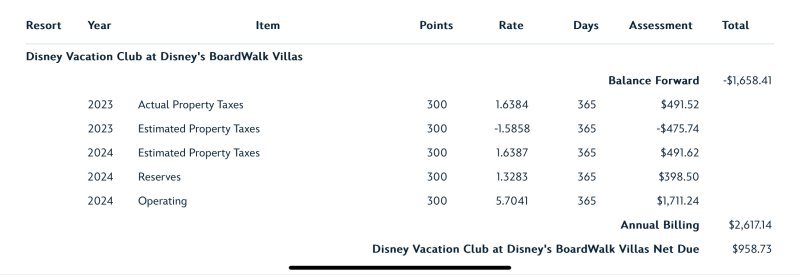

I'm not sure if to be thrilled or cry lol

DVC offers two options for Auto-Pay; a yearly payment on January 15th with a credit card or monthly payments with a U.S. bank account. By registering for Dues Auto-Pay, you can enjoy the magic of Membership without the worry of missing a payment.

To avoid late fees and interest assessments, Annual Dues payments must be posted to your account by February 14th. Late fees and interest will be assessed beginning February 15th, and each month thereafter on any past due balance.

I'm not sure if to be thrilled or cry lol