Some of us on here are looking at this through some hard core rose colored glasses but just a little word of advice...

EVEN if SOMEHOW you think none of the current politics makes a lick of difference...and EVEN if you think somehow Dis+ isn't going to lose a lot of subscribers which is all Wall Street ever cares about lately, and EVEN IF you don't see how every earnings and everything is being sold off regardless because we are in the throes of a major bear market that we won't be coming out of anytime soon...

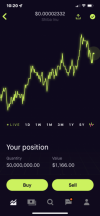

If you want to keep purchasing I would DCA very cautiously. The 116 support was broken today. Tomorrow we may have a relief rally...maybe and that's only because Microsoft saved the market's behinds. But in general the next stop is low 100's. That would seem like a good place to start moving the chips in if you really want more Disney stock (Although I recommend looking around at all the fire sales around you). Let's hope it finds support there because if it somehow breaks 100 we're for sure looking at an $85 retest. Going back to 85 would be an unmitigated disaster. Even low 100s is absolutely dreadful. Heck right now at 115 is almost unfathomable considering in 2015 the stock was at 118.

I mean we can be in love with Disney...we can hope for the best with the stock we own...but closing your eyes to the reality of the market and not seeing the macro and micro trends is not what makes a good investor. The trend is your friend.