ehh

I'm not all there myself

- Joined

- Aug 3, 2019

Monthly update!

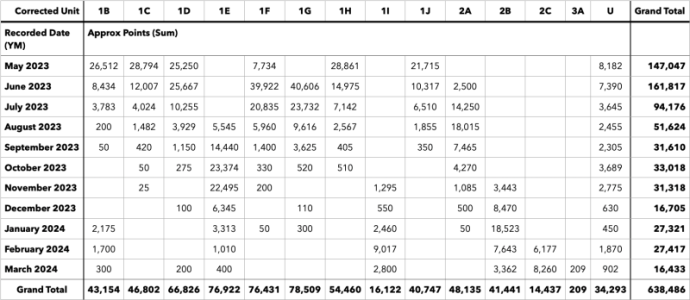

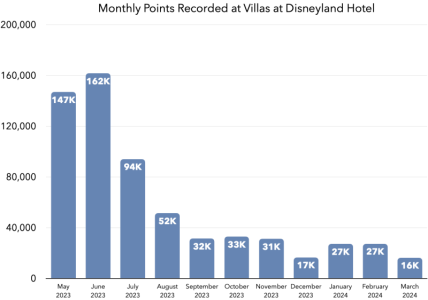

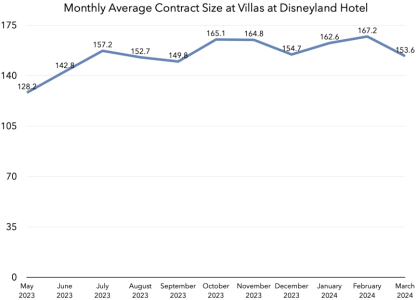

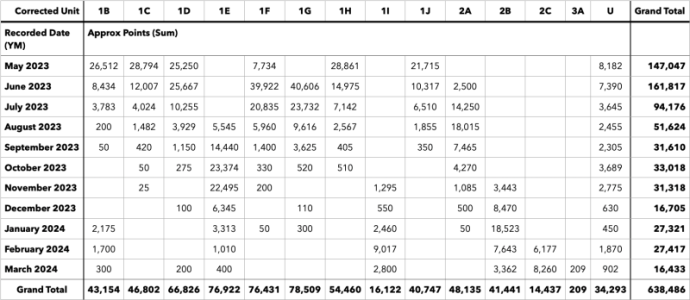

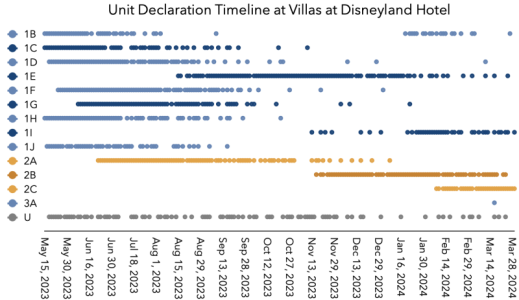

Total points recorded as of March 31st: ~638k points (19.6% of all points).

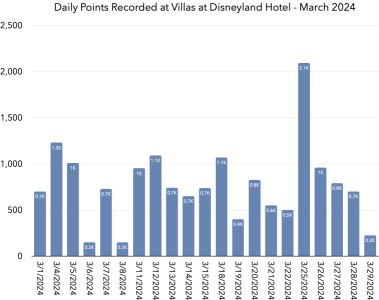

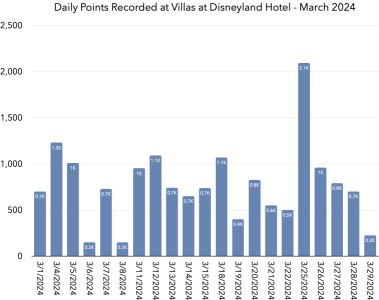

Points recorded in March: ~16.4k points.

Prices went up Feb 1, so after considering the 2-3 week typical recording delays, March was the first 'full' month of deeds being recorded of sales at the higher prices. And sales were the lowest ever for VDH, even lower than the abysmal December 2023 (16.7k). And a large portion of March's recorded deeds appeared to be at the old price, too.

At the current rate, VDH will sell out in a whopping 160 months, or 13.3 years from now...roughly mid/late 2038!

The recent price/incentive updates are our first indications that maybe DVD wants to pick up the pace a bit as 200+ point contracts are now available below pre-sales pricing, as long as you qualify for the Welcome Home incentive. Will be interesting to look for a potential uptick in larger contracts with this new pricing structure.

As of March 31st, ~22.3% of points are declared and at least ~19.6% of the resort has been sold. That leaves about 2.5% of headroom, roughly 90k points, before more Units must be declared. At the current sales rate, DVD still has a few months before needing to do this. Starting to feel like Zeno's dichotomy paradox.

Something I noted last two months but continues to be a thorn to sales monitoring is a change OCRW made. Previously, OCRW would publish the Lot Number, the Transfer Tax Amount, and the Unit #. Now they just post Transfer Tax and Unit #, making it harder to differentiate VGC sales from VDH (which have different lot numbers). Yes, DVC has been selling a trickle of VGC this entire time.

In March, it actually seemed like there was an uptick in VGC contracts, which I've excluded from the VDH sales data when it's more likely than not a contract is for VGC.

DVD also increased the base price for VDH, which also has an impact to sales monitoring. Without getting too inside baseball, OCRW doesn't post how many points are sold, just the Transfer Tax paid. Transfer Tax is proportional to the pre-incentive price of the contract. So a 150pt contract at a $230/pt base price would show up as $37.95 of Transfer Tax, but at the new $239/pt base price it shows up as 39.60. But 39.60 was also a valid tax amount before for a 155pt or 156pt contract, so discerning whether a contract is on the new pricing or old pricing is a bit of a judgement call currently.

I estimate 63 of the 107 contracts recorded this month were at the higher $239/pt. I'm a bit surprised that 44 of 107 had such a delayed closing that they qualified for the older pricing.

I'll do my best to take educated guesses on the contract size, but there have definitely been some challenges.

As a reminder, I'm just doing ad hoc and monthly updates now.

Fun facts about March's sales:

March had a fairly interesting largest contract: 617 points. Why would someone buy this size contract? It doesn't appear to be a Favorite Week and it's just a weird number of points. There's an outside chance it's actually a 475 VGC contract.

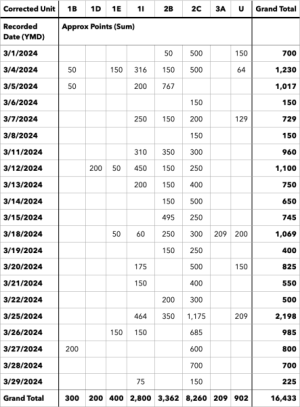

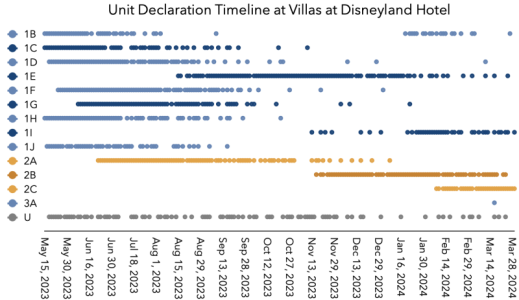

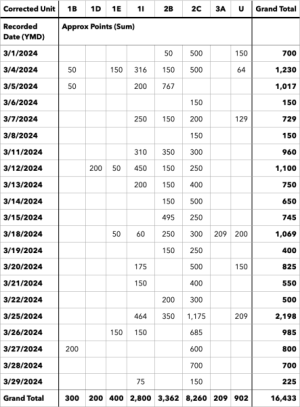

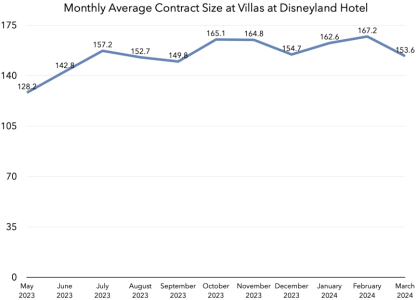

Unit 2C was the top seller in just its second month of being recorded. I think all declared Units, except 1A, have now appeared in recorded contracts (there might be a small Unit 2D). Unit 2B remained a solid seller in 2nd place. The burst of Unit 1B appears to have ended, and I'm still not sure why it even happened in the first place.

It is likely that a bunch of Units are now sold out: 1B, 1C, 1D, 1F, 1G, 1H, 1J, and maybe 2A. We still haven't seen 1A show up in any recorded deeds yet.

There was also a recorded deed for Unit 3A. However, there have been no other signs that Unit 3A has even been declared, so I'm not sure what to make of this. Did VGC have a Unit 3A? Does VDH even have a 3A? This deed would have been 209 points (a weird number and not a FW) at $239 but 160pts or 161pts at VGC's current price.

Other interesting facts about the contracts recorded in March:

"U" unit stands for "Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

Points recorded by month:

Total points recorded as of March 31st: ~638k points (19.6% of all points).

Points recorded in March: ~16.4k points.

Prices went up Feb 1, so after considering the 2-3 week typical recording delays, March was the first 'full' month of deeds being recorded of sales at the higher prices. And sales were the lowest ever for VDH, even lower than the abysmal December 2023 (16.7k). And a large portion of March's recorded deeds appeared to be at the old price, too.

At the current rate, VDH will sell out in a whopping 160 months, or 13.3 years from now...roughly mid/late 2038!

The recent price/incentive updates are our first indications that maybe DVD wants to pick up the pace a bit as 200+ point contracts are now available below pre-sales pricing, as long as you qualify for the Welcome Home incentive. Will be interesting to look for a potential uptick in larger contracts with this new pricing structure.

As of March 31st, ~22.3% of points are declared and at least ~19.6% of the resort has been sold. That leaves about 2.5% of headroom, roughly 90k points, before more Units must be declared. At the current sales rate, DVD still has a few months before needing to do this. Starting to feel like Zeno's dichotomy paradox.

Something I noted last two months but continues to be a thorn to sales monitoring is a change OCRW made. Previously, OCRW would publish the Lot Number, the Transfer Tax Amount, and the Unit #. Now they just post Transfer Tax and Unit #, making it harder to differentiate VGC sales from VDH (which have different lot numbers). Yes, DVC has been selling a trickle of VGC this entire time.

In March, it actually seemed like there was an uptick in VGC contracts, which I've excluded from the VDH sales data when it's more likely than not a contract is for VGC.

DVD also increased the base price for VDH, which also has an impact to sales monitoring. Without getting too inside baseball, OCRW doesn't post how many points are sold, just the Transfer Tax paid. Transfer Tax is proportional to the pre-incentive price of the contract. So a 150pt contract at a $230/pt base price would show up as $37.95 of Transfer Tax, but at the new $239/pt base price it shows up as 39.60. But 39.60 was also a valid tax amount before for a 155pt or 156pt contract, so discerning whether a contract is on the new pricing or old pricing is a bit of a judgement call currently.

I estimate 63 of the 107 contracts recorded this month were at the higher $239/pt. I'm a bit surprised that 44 of 107 had such a delayed closing that they qualified for the older pricing.

I'll do my best to take educated guesses on the contract size, but there have definitely been some challenges.

I figure most people won't care about this so gonna bury this into a spoiler, but some contracts recorded this month were fairly interesting from my perspective.

Feb Contract 1 - $48.40 Transfer Tax

Never seen this amount before. For $230/pt it works out to 190pt or 191pt and for $239 it works out to 183pt or 184pt. I went with 184pt as it has the most Favorite Week matches, but 191pt also has a bunch of matches (arguably more worthwhile matches, too).

Feb Contract 2 - $110.00 Transfer Tax

Also never seen this amount before. For $230/pt it works out to 433pt or 434pt and for $239/pt it works out to 417pt or 418pt. I went with 433pt, which is a match for a W51/52 1BR, but 417pt would have been a match for W18 2BR.

March Contract 1 - $112.20 Transfer Tax

Never seen this amount before. For $230/pt it works out to 442pt or 443pt and for $239 it works out to 426pt or 425pt. None of these appear to be matches for Favorite Weeks. I went with 425pt as it is the most round number and aligns with the current pricing.

Multiple contracts - $39.60 Transfer Tax

Unlike the above 2, I have seen this before. It works out to 155pt or 156pt in $230/pt pricing (I've been assuming 155pt). But it's also 150pt in $239/pt pricing, which is the most common contract size. I'm going to assume all $39.60 are 150pt on $239/pt pricing until the next price increase.

(let me know if you found me showing my math/process interesting)

Feb Contract 1 - $48.40 Transfer Tax

Never seen this amount before. For $230/pt it works out to 190pt or 191pt and for $239 it works out to 183pt or 184pt. I went with 184pt as it has the most Favorite Week matches, but 191pt also has a bunch of matches (arguably more worthwhile matches, too).

Feb Contract 2 - $110.00 Transfer Tax

Also never seen this amount before. For $230/pt it works out to 433pt or 434pt and for $239/pt it works out to 417pt or 418pt. I went with 433pt, which is a match for a W51/52 1BR, but 417pt would have been a match for W18 2BR.

March Contract 1 - $112.20 Transfer Tax

Never seen this amount before. For $230/pt it works out to 442pt or 443pt and for $239 it works out to 426pt or 425pt. None of these appear to be matches for Favorite Weeks. I went with 425pt as it is the most round number and aligns with the current pricing.

Multiple contracts - $39.60 Transfer Tax

Unlike the above 2, I have seen this before. It works out to 155pt or 156pt in $230/pt pricing (I've been assuming 155pt). But it's also 150pt in $239/pt pricing, which is the most common contract size. I'm going to assume all $39.60 are 150pt on $239/pt pricing until the next price increase.

(let me know if you found me showing my math/process interesting)

As a reminder, I'm just doing ad hoc and monthly updates now.

Fun facts about March's sales:

March had a fairly interesting largest contract: 617 points. Why would someone buy this size contract? It doesn't appear to be a Favorite Week and it's just a weird number of points. There's an outside chance it's actually a 475 VGC contract.

Unit 2C was the top seller in just its second month of being recorded. I think all declared Units, except 1A, have now appeared in recorded contracts (there might be a small Unit 2D). Unit 2B remained a solid seller in 2nd place. The burst of Unit 1B appears to have ended, and I'm still not sure why it even happened in the first place.

It is likely that a bunch of Units are now sold out: 1B, 1C, 1D, 1F, 1G, 1H, 1J, and maybe 2A. We still haven't seen 1A show up in any recorded deeds yet.

There was also a recorded deed for Unit 3A. However, there have been no other signs that Unit 3A has even been declared, so I'm not sure what to make of this. Did VGC have a Unit 3A? Does VDH even have a 3A? This deed would have been 209 points (a weird number and not a FW) at $239 but 160pts or 161pts at VGC's current price.

Other interesting facts about the contracts recorded in March:

- 107 contracts recorded

- 42x 150pt contracts (49 the prior month)

- 14x 200pt contracts (28 the prior month)

- 13x 50pt contracts (20 the prior month)

- 10x 100pt contracts (18 the prior month)

- 14x 250pt contracts (16 the prior month)

- 2x 300pt contracts (6 the prior month)

- 22x other contracts (27 the prior month)

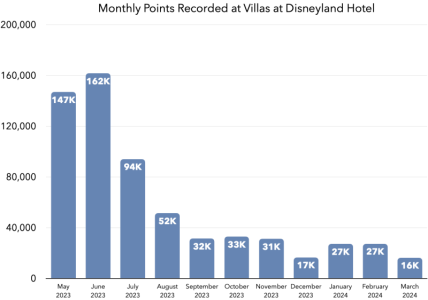

- 153.6pt average contract size in March, lowest in the last 6 months

- May had an average of 128.2pt

- June had an average of 142.8pt

- July had an average of 157.2pt

- August had an average of 152.7pt

- September had an average of 149.8pt

- October had an average of 165.1pt

- November had an average of 164.8pt

- December had an average of 154.7pt

- January 2024 had an average of 162.6pt

- February 2024 had an average of 167.2pt, highest ever

- 617pt is largest contract in March

- 50pt is smallest contract

- 350pt is the largest contract size purchased multiple times (2x)

- Unit 2C was assigned the most (8.3k, 2nd most was 2B at 3.4k)

"U" unit stands for "Unknown". This is because OCRW recorded a Unit number with an error and no 'most likely' correct fix. This is most likely due to issues with OCR (optical character recognition) used in their recording process.

Points recorded by month:

Last edited: