https://www.spritzlerreport.com/post/it-s-been-30-years-since-food-ate-up-this-much-of-your-income

It’s Been 30 Years Since Food Ate Up This Much of Your Income

Ongoing high costs lead food manufacturers and restaurants to keep prices elevated

By Jesse Newman and Heather Haddon, WSJ

Feb. 21, 2024 - 5:30 am EST

The last time Americans spent this much of their money on food, George H.W. Bush was in office, “Terminator 2: Judgment Day” was in theaters and C+C Music Factory was rocking the Billboard charts.

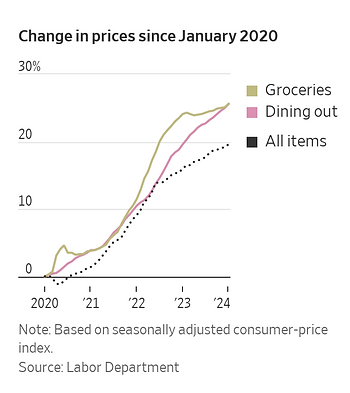

Eating continues to cost more, even as overall inflation has eased from the blistering pace consumers endured throughout much of 2022 and 2023. Prices at restaurants and other eateries were up 5.1% last month compared with January 2023, while grocery costs increased 1.2% during the same period, Labor Department data show.

Relief isn’t likely to arrive soon. Restaurant and food company executives said they are still grappling with rising labor costs and some ingredients, such as cocoa, that are only getting more expensive. Consumers, they said, will find ways to cope.

“If you look historically after periods of inflation, there’s really no period you could point to where [food] prices go back down,” said Steve Cahillane, chief executive of snack giant Kellanova, in an interview. “They tend to be sticky.”

Companies are set to pay more for staffing, after 22 states in January lifted the minimum wage for hourly workers.

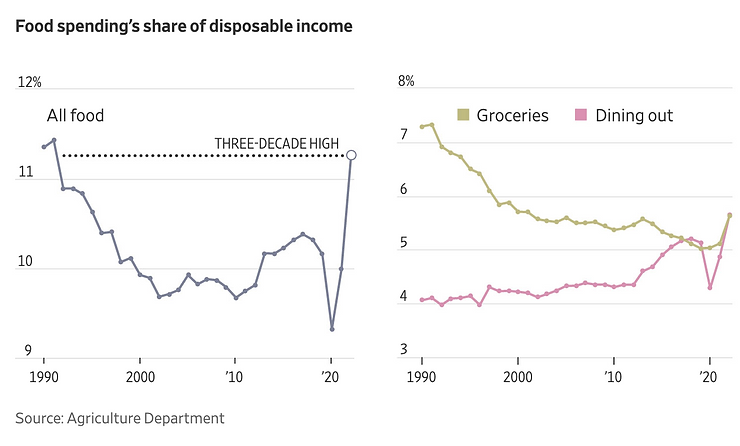

In 1991, U.S. consumers spent 11.4% of their disposable personal income on food, according to data from the U.S. Agriculture Department. At the time, households were still dealing with steep food-price increases following an inflationary period during the 1970s.

More than three decades later, food spending has reattained that level, USDA data shows. In 2022, consumers spent 11.3% of their disposable income on food, according to the most recent USDA data available.

Food inflation has raised the ire of President Biden, who took to Instagram during the Super Bowl to blast food makers that he said were providing less bang for consumers’ buck—putting fewer chips in each bag or shrinking the size of ice-cream containers.

“The American public is tired of being played for suckers,” Biden said. “I’ve had enough of what they call shrinkflation. It’s a rip-off.”

David Chavern, CEO of the Consumer Brands Association, which represents major food manufacturers, said the industry offers many choices at different price points. “We hope to work with the president on real solutions that benefit consumers,” he said.

In suburban Chicago, Lisa Wister said her food bills are rising faster than her family’s income, leading them to make their own granola from scratch and pack their own snacks for the movies. “Everything is a negotiation, an analysis about our budget,” said Wister, an occupational therapist. “It’s exhausting.”

Many diners have said they are going out less frequently or skipping appetizers, while buying cheaper store brands more frequently at supermarkets and seeking out promotions or deals offered via apps. That is starting to chip away at some sales for food makers and restaurant operators.

Denny’s, Wendy’s and other restaurant chains told investors this month that their guest counts fell last year compared with 2022 levels as consumers, in particular those with lower incomes, feel the financial pinch. Big food makers including Hershey and Kraft Heinz have reported that their sales volumes declined as prices rose for their products, with several reporting a hit to profits in the latest fiscal year—and others an increase.

Food companies said they are feeling pinched themselves. While commodities such as corn, wheat, coffee beans and chicken have gotten cheaper, prices for sugar, beef and french fries are still high or rising.

Oreo maker Mondelez said in January it would continue raising prices on some of its products this year, largely because of cocoa prices, which earlier in February surged past a 46-year record. Hershey said this month it expects more expensive cocoa to cut into the company’s profit this year. Kraft Heinz said inflation is moderating but that its costs are still higher, driven in part by pricier tomatoes and sugar.

Companies are set to pay more for staffing, after 22 states in January lifted the minimum wage for hourly workers. Hiring skilled workers like mechanics to replace employees who retired during the pandemic is particularly expensive, said Henk Hartong, CEO of Brynwood Partners, which owns 17 food and beverage plants that make Pillsbury cake mixes and other products.

Restaurant chains said they are trying to operate more efficiently to help defray wage increases, but they also expect to raise prices.

“It’s a really fast move and a high percent increase,” Chipotle Mexican Grill CEO Brian Niccol said in an interview, referring to California’s 25% minimum wage increase for fast-food workers employed by large chains, set to take effect in April. “Pricing is going to be part of the puzzle.”

When Anna Zabinski and her husband eat out these days, she said, they ask themselves whether a side of macaroni and cheese is worth the extra $1.99, and often go for refills instead of ordering more expensive large-size drinks.

Zabinski, a professor from Normal, Ill., said they’ll sometimes split a $20 steak and side dish at Texas Roadhouse or a large sandwich from Jimmy John’s. Nonetheless, she said, “our daily and monthly expenditures still seem higher than even two years ago.”

Food manufacturers and restaurants have been offering more deals on some items. J.M. Smucker and Conagra have reduced prices on coffee and margarine, passing through lower costs for coffee beans and edible oils. McDonald’s and Wendy’s said they would offer deals this year aimed at consumers seeking relief from rising prices.

Gary Pilnick, chief executive of WK Kellogg, said the company has been working to market cereals such as Frosted Flakes and Froot Loops to pressured consumers. An ad campaign launched in 2022, for example, encouraged consumers to eat cereal for dinner, pitching it as an easy, inexpensive alternative that, combined with milk and fruit, costs less than $1 per serving. “Give chicken the night off,” the campaign’s tagline says.

Although it is rare for food prices to retreat, it is also unusual for prices to skyrocket as much as they have in recent years, said TD Cowen analyst Robert Moskow. He said he expects grocery prices to decline for a period this year as food makers come under pressure from consumers and retailers.

Kraft Heinz said it is focused on providing affordable options for families, and that while its costs rose 3% in 2023, it raised prices by 1%. WK Kellogg said that before raising prices, the company tries to combat higher costs through greater productivity.

Kellanova said it is working to keep prices as low as possible. Cahillane declined to comment on pricing for his company’s products this year but said that the maker of Pringles and Pop-Tarts hasn’t raised prices to pad its profit.

Cahillane said that as consumers become accustomed to seeing higher prices on supermarket shelves, they will adjust.

“Just like a gallon of gas, it becomes the new price and people get begrudgingly used to it,” he said.