I just read this on Yahoo Finance:

U.S. homeowners have lost $2.3 trillion since June, according to a new report from the real-estate brokerage Redfin. The total value of U.S. homes was $45.3 trillion at the end of 2022, down 4.9% from a record high of $47.7 trillion in June. That figure signifies the largest June-to-December percentage decline since 2008.

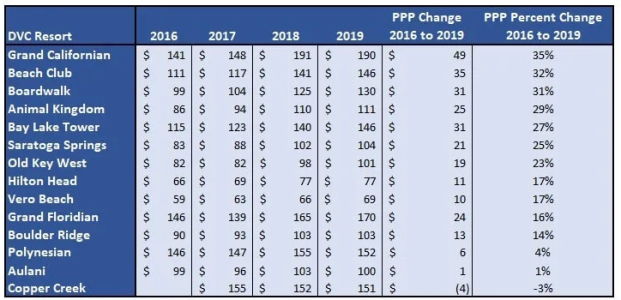

Of course, a couple of years after this 2008 real-estate decline is when we saw DVC prices hit record lows. Are we going to see the same in 2023 and 2024?