We own a several subsidized contracts. As others have mentioned, they are relatively hard to find and a lot of them will come stripped of points for the next 1-2 years. With that said, it can be shown that the subsidy is worth $60-$90 per point so, in theory, a buyer can pay up to that amount more for a subsidized contract relative to an identical unsubsidized contract and still some out ahead. That's all academic though because in practice the premium for the subsidized contract is lower and so, in my view, they should be favored by a buyer unless we're looking at a very cheap unsubsidized contract or a very expensive subsidized contract. A very loaded unsubsidized contract versus a very stripped subsidized contract can also potentially tilt the scales the other way.

The math is relatively simple because, as alluded to by

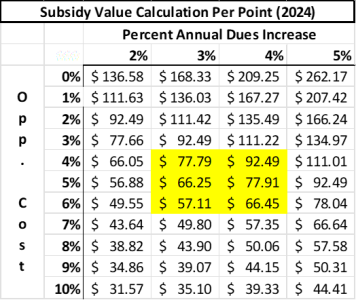

@intamin, only two things matter - the average dues growth rate and the opportunity cost. If the dues growth rate and the opportunity cost are equal (say both 4%, or both 3%, or some other number), then they cancel each other out and the benefit of the subsidy is $2.43 x 38 years or about $92.5 per point. All else equal, higher (lower) dues growth rates increase (decrease) the value of the subsidy, and a higher (lower) opportunity cost decreases (increases) the value of the subsidy since the future savings are worth less (more). One can run a sensitivity analysis on those two variables and you'd get the following when 2024 is the first subsidy year (yellow marks what I think are the most realistic assumptions):

View attachment 818481

Keep in mind that even if you don't keep the contract to expiration, a subsidized contract should always sell for more than an identical unsubsidized one, so it's not like if you sell in 5-10 years you will necessarily lose out on the subsidized contact. But if the market tends to undervalue the subsidized contracts relative to their economic value, you probably want to be careful not to overpay too much yourself.