DanCali

DIS Veteran

- Joined

- Mar 9, 2023

My math is that subsidized isn’t worth the premium. You can get unsubsidized Aulani for $90/point and subsidized for $115/point. You pay basically a 25% premium upfront for about a $25% savings on dues. The problem is the time value of money. That $25 per point you spend today is worth A LOT more than any savings on dues you’ll get 10, 20, 30 years down the line. You could instead invest that upfront savings and save more down the line. Or alternatively, you could do the prudent thing and just buy more unsubsidized points.

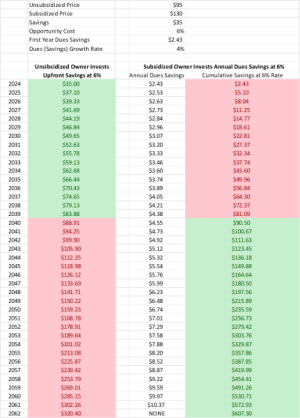

You are correct that the dues matter and also the time value of money. But don't forget (1) the dues also grow over time - the more they grow, the more the value of the subsidy increases, and (2) the annual savings from the dues can/should also be invested and whatever rate of return you picked - this is actually key because you're investing a growing annuity and it eventually catches up to what the nonsubsidized contract saves upfront.

You're not likely to get a subsidized contract for $115. But, for example, using your numbers, a person buying a 100-point unsubsidized contract at $90 (instead of $115) gets to invest $2500 at X% for 38 years. If you pick a high number like 10% you end up with $112K after 38 years(!) - That's likely the point you're making, and it's totally valid if you can get that 10% rate of return over 38 years.

But the person buying the subsidized contract gets to invest $243 in annual dues savings in the first year also at 10%. And if the dues grow at 4% annually they invest another $253 the following year, and another $263 the following year etc all that that 10% rate of return... and after 38 years they end up with over $133K in savings(!!)

The math can be simplified quite a bit and if you run the numbers like I did (see post #15), taking into account both the dues growth rate and your expected return on investment (aka "time value of money"), you will see that the value of the subsidy is a lot more than you might think.

Based on that analysis, if you assume that the dues grow at 2% and your return on investment (aka "opportunity cost", aka "time value of money") is 10% the subsidy is worth about $30/pt (a bit more than the $25 you are suggesting). But with more conservative numbers like dues growing at 3% and opportunity cost of 6%, the value of the subsidy doubles to around $60/pt.

Last edited: