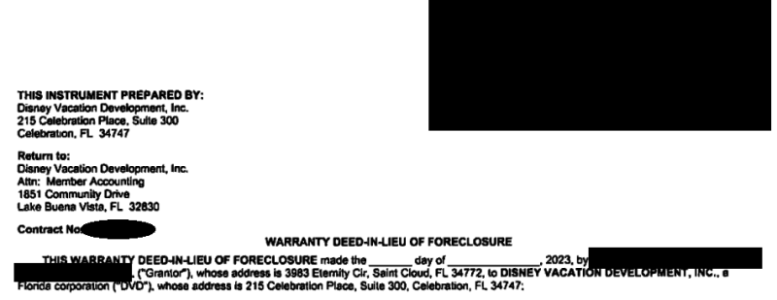

A quick search on the Orange County website shows they do a lot more foreclosures than "Warranty Deed in Lieu of Foreclosure". But they also do the latter, at least according to a SSR deed recorded as recently as last quarter. I posted the example below but I'm not posting personal information or the document number or the exact recording date beyond what I wrote. If you know how to search the site, it's not hard to find such examples.

So your broker was correct and the quality assurance managers may have been misinformed... But I agree it does not appear like a regular thing they do.

View attachment 799935