I am not a tax professional but if it is was a rental, you'd be paying income tax in 2023. And I suspect the tax would be on the full amount (~30%) because the annual dues you pay are based on prorated calendar year and the same whether you take advantage of MB or not.

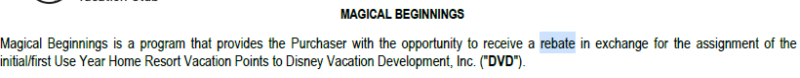

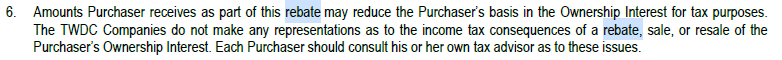

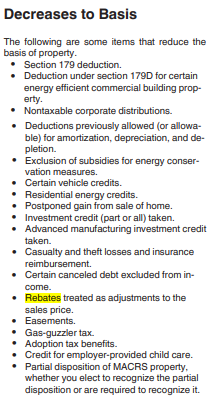

However, Disney refers to it as a "rebate" which, based on IRS publications, reduces your tax cost basis. This will impact your capital gain if/when you sell (you will have a bigger gain or smaller loss) but there would be no immediate tax consequences.

View attachment 809196

View attachment 809199

Here is a link to IRS Pub 551 -

https://www.irs.gov/pub/irs-pdf/p551.pdf

The following is from page 5:

View attachment 809194

If you accept that interpretation, then you did technically buy for $161 and just started usage of the property later. As I mentioned, I am not a tax advisor, but I do think there is a very good reason they call it a rebate and not a rental, and you can only do it at the time of purchase.