After reading thru this thread, I figure I might as well just post my question about the AAdvantage Citi card...

We've booked our upcoming July trip at WL & Destino. Put down the $200 deposits with the balance due in June.

We've never used any kind of airline/hotel/travel related card, just a regular bank CC.

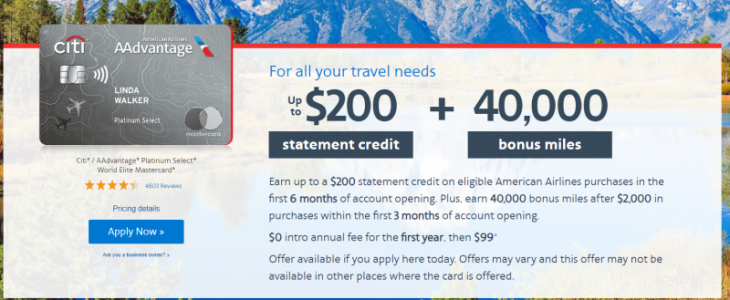

Recently booked our AA flights. During the process it made it look as thought signing up for the AAdvantage Citi card before checkout would bring some point/miles/bonus/whatever. Apparently not. Nothing about the application passed thru and we paid for the flight with our regular bank CC.

AA/Citi phone customer service was beyond bad. Neither side could answer any good questions and kept passing back to the other side, resulting in auto-voice grid lock with nothing accomplished.

Just got the Platinum Select card in the mail, and when I called to activate it, (again with extremely confusing customer service) asked...

1 Could the recent purchase of the AA flight be applied to this card? (apparently not)

2 Does this card offer decent points/miles/whatever if I use it to pay the (several thousand $$$) balance of our WDW Resort stay w parks tickets? (anyone know? they didn't)

Any help is much appreciated, thanks.