I like where this is going and think it would be good to add in add standard hotel rooms for a more diverse set of data. I'll ignore the 1-of-1 suites as those can go for 10k/night after tax

Peak season (highest on VGC calendar):

| Hotel room, 4/9/23 - 4/16/23, by view | Disneyland Hotel | Grand Californian Hotel | GCH Premium |

| Standard view | 5136.30 | 6535.62 | 27.2% |

| Woods-courtyard view | | 6751.41 | [no matching view] |

| Partial view | | 7265.70 | [no matching view] |

| Downtown Disney view | | 7658.82 | VG-DTD vs DL-PDTD: 20.3% |

| Pool view | | 7837.83 | Max vs. max: 23.1%; VGPool vs. DLPremium: 31.8%; VGPool vs. DLDeluxe: 38.4% |

| Deluxe view (view of pool) | 5663.97 | | VGPool vs. DLDeluxe: 38.4% |

| Premium view (view of pool) | 5947.11 | | VGPool vs. DLPremium: 31.8% |

| Premium Downtown Disney view | 6364.80 | | VG-DTD vs DL-PDTD: 20.3%; Max vs. max: 23.1% |

| | | Typical premium: ~26% (not counting Pool vs. Deluxe) |

Lower season (2nd lowest on VGC calendar)

| Hotel room, 5/7/23 - 5/14/23, by view | Disneyland Hotel | Grand Californian Hotel | GCH Premium |

| Standard view | 4312.62 | 5507.19 | 27.7% |

| Woods-courtyard view | | 5854.68 | [no matching view] |

| Partial view | | 6334.38 | [no matching view] |

| Downtown Disney view | | 6635.07 | VG-DTD vs DL-PDTD:24.7% |

| Pool view | | 6867.90 | Max vs. max: 29.1%; VGPool vs. DLPremium: 37.6%; VGPool vs. DLDeluxe: 45.8% |

| Deluxe view (view of pool) | 4710.42 | | VGPool vs. DLDeluxe: 45.8% |

| Premium view (view of pool) | 4992.39 | | VGPool vs. DLPremium: 37.6% |

| Premium Downtown Disney view | 5318.82 | | VG-DTD vs DL-PDTD: 24.7%; Max vs. max: 29.1% |

| | | Typical premium: ~30% (not counting Pool vs. Deluxe) |

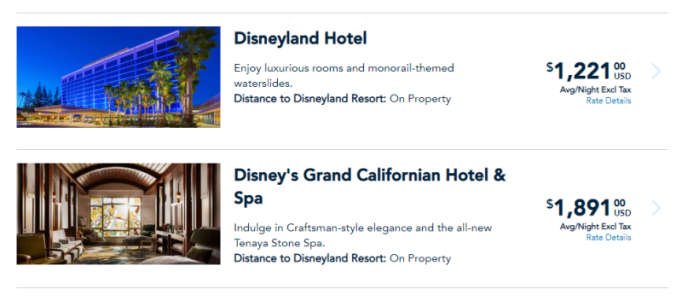

Lower rack rates make a good argument that VDH will have a lower points chart, on average, than VGC. Though I'd be doubtful of VGC maintaining a 25-30% premium, which would put VDH just above BCV/BRV/CCV. Something like the BLT-RVA range, with a variety of views, feels more right to me, but I am definitely guessing.

VGC already has a pretty heavy points chart, too, so there is wiggle room below. Comparison of all resorts:

| Average weeks by resort: | Studio | 1 Bedroom | 2 Bedroom |

| AUL | 172.7 | 333.0 | 457.7 |

| VGF | 167.8 (156.9 pre-VGF2) | 328.7 | 449.9 |

| VGC | 164.6 | 323.6 | 444.4 |

| Poly | 157.7 | - | - |

| RVA | 155.1 (excluding Tower Studios) | 327.9 | 421.9 |

| BLT | 141.2 | 273.0 | 373.5 |

| VBR | 132.9 | 218.0 | 292.3 |

| BCV | 121.7 | 247.7 | 320.8 |

| BRV | 121.5 | 247.2 | 320.6 |

| CCV | 121.2 | 247.5 | 320.3 |

| BWV | 118.7 | 240.5 | 308.9 |

| SSR | 106.7 | 220.3 | 286.6 |

| HHI | 100.5 | 197.2 | 248.5 |

| OKW | 93.7 | 197.2 | 269.4 |

(all numbers above are properly weighted by the count of rooms in the view category and number of nights in each points season)